Compare car insurance online – Embark on a journey of comparison and discovery as we dive into the world of online car insurance comparisons. With the power of the internet at your fingertips, uncover the secrets to finding the perfect policy for your needs and budget.

In this comprehensive guide, we’ll navigate the ins and outs of comparing car insurance online, empowering you with the knowledge to make informed decisions. From understanding the benefits to deciphering quotes, we’ve got you covered every step of the way.

Benefits of Comparing Car Insurance Online

Comparing car insurance online offers a myriad of advantages, empowering consumers to make informed decisions and secure the most suitable coverage for their needs. By leveraging the convenience and accessibility of the internet, individuals can reap significant benefits that were previously unavailable through traditional methods.

One of the primary advantages of comparing car insurance online is the potential for substantial cost savings. Online comparison platforms provide access to quotes from multiple insurers, allowing consumers to identify the most competitive rates and discounts. This transparent comparison process empowers individuals to make informed decisions, ensuring they secure the best possible coverage without overpaying.

Convenience and Time-saving

Comparing car insurance online offers unparalleled convenience and time-saving benefits. Gone are the days of visiting multiple insurance agents or spending hours on the phone gathering quotes. Online comparison platforms streamline the process, enabling consumers to compare multiple policies from the comfort of their own homes.

This convenience not only saves time but also eliminates the hassle associated with traditional methods.

Access to a Wider Range of Options

Online comparison platforms provide access to a wider range of insurance options compared to traditional methods. By partnering with multiple insurers, these platforms offer a comprehensive selection of policies tailored to diverse needs and budgets. This expanded choice empowers consumers to find the coverage that aligns precisely with their unique requirements, ensuring they secure the most suitable protection for their vehicles and financial well-being.

Steps to Compare Car Insurance Online

Comparing car insurance online can save you time and money. Here’s a step-by-step guide to help you get started.

First, gather the necessary information. This includes your driving history, vehicle information, and coverage needs. You can find this information on your driver’s license, vehicle registration, and insurance policy.

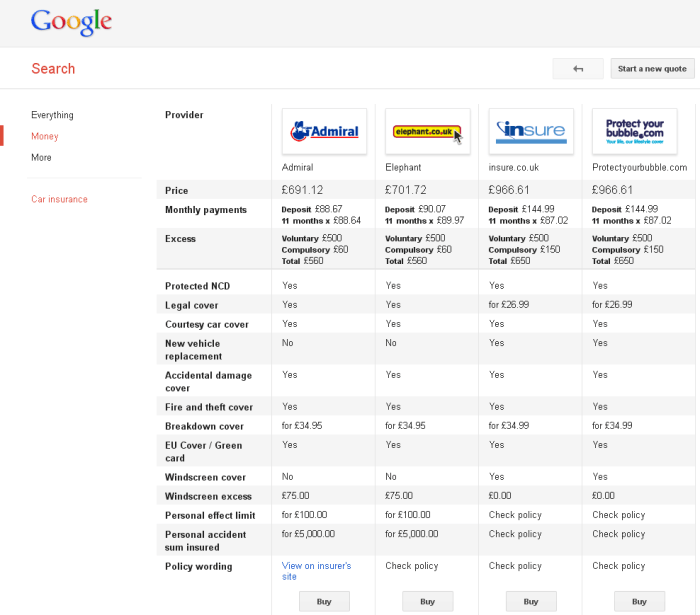

Use comparison websites, Compare car insurance online

Once you have your information, you can start comparing car insurance quotes. There are a number of websites that allow you to do this, such as NerdWallet, The Zebra, and Insurify. These websites will ask you for your information and then provide you with quotes from multiple insurance companies.

Understanding quotes

When you’re comparing quotes, it’s important to understand what you’re looking at. The quote will include the premium, which is the amount you’ll pay for your insurance each month. It will also include the deductible, which is the amount you’ll have to pay out of pocket before your insurance kicks in.

Once you’ve compared quotes and found a policy that you’re happy with, you can purchase it online. The process is usually quick and easy, and you can have your new insurance policy in place in minutes.

Factors to Consider When Comparing Car Insurance

Comparing car insurance policies can be overwhelming, but considering key factors can help you make an informed decision. Here are the essential elements to evaluate:

Coverage Types: Understand the types of coverage available, including liability, collision, comprehensive, and uninsured/underinsured motorist. Determine the level of protection you need based on your individual circumstances and risk tolerance.

Deductibles

Deductibles are the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles typically lower your premiums, but they also increase your financial responsibility in the event of an accident. Consider your financial situation and risk tolerance when selecting a deductible.

Premiums

Premiums are the periodic payments you make to maintain your insurance coverage. They are determined by various factors, including your driving history, age, location, and the coverage you choose. Compare premiums from different insurers to find the best deal.

Policy Limits

Policy limits determine the maximum amount your insurance company will pay for covered expenses in the event of an accident. Liability limits cover bodily injury and property damage caused to others, while collision and comprehensive limits cover damage to your own vehicle.

Consider your assets and potential risks when setting policy limits.

Understanding Car Insurance Quotes

Car insurance quotes are estimates of the premium you’ll pay for an insurance policy. They provide a snapshot of the coverage and cost of a policy, but it’s important to understand what they cover and how to interpret them.

Quotes typically include the following information:

- Coverage limits:The maximum amount the insurance company will pay for each type of coverage (e.g., liability, collision, comprehensive).

- Deductible:The amount you pay out-of-pocket before the insurance company starts paying.

- Premium:The monthly or annual cost of the policy.

Several factors can affect car insurance quotes, including:

- Driving history:Drivers with clean records typically pay lower premiums than those with accidents or traffic violations.

- Vehicle type:More expensive or powerful vehicles usually have higher premiums.

- Location:Insurance rates vary by state and city due to factors such as crime rates and traffic congestion.

Tips for Interpreting Car Insurance Quotes

- Compare quotes from multiple insurance companies to get the best rate.

- Make sure you understand the coverage limits and deductibles before purchasing a policy.

- Consider your budget and driving habits when choosing a policy.

Tips for Choosing the Right Car Insurance Policy

Selecting the most suitable car insurance policy is crucial for protecting your vehicle and financial well-being. Here are some practical tips to help you make an informed decision:

Read Reviews and Check Financial Stability

Thoroughly research potential insurance providers by reading online reviews from reputable sources. This will give you insights into their customer service, claims handling, and overall reliability. Additionally, check the financial stability of the insurer through independent ratings agencies to ensure they have the resources to honor claims.

Consider Discounts and Savings

Take advantage of discounts offered by insurance companies for factors such as safe driving habits, multiple vehicles, and loyalty. These discounts can significantly reduce your premiums. Explore additional savings options, such as bundling home and auto insurance or participating in safe driving programs.

Tailor Coverage to Your Needs

Assess your individual driving habits, vehicle value, and financial situation to determine the appropriate level of coverage. Consider factors such as liability limits, collision coverage, and comprehensive coverage. Choose a policy that provides adequate protection without overpaying for unnecessary coverage.

Compare Quotes from Multiple Providers

Don’t limit yourself to a single insurance company. Obtain quotes from multiple providers to compare coverage options and premiums. This will help you identify the most competitive rates and ensure you’re getting the best value for your money.

Consult with an Insurance Agent

If you need guidance or have complex insurance needs, consider consulting with an experienced insurance agent. They can provide personalized advice, explain different coverage options, and help you navigate the insurance process.

Closing Notes

As you embark on your online comparison journey, remember to prioritize your specific needs and budget. By following the steps Artikeld in this guide, you’ll be well-equipped to choose the car insurance policy that provides the optimal balance of coverage and affordability.

Remember, the power of comparison lies in your hands. Embrace it, explore your options, and drive with confidence knowing you’ve secured the best possible protection for your vehicle.