Best cheapest car insurance – In the realm of car insurance, finding the best and cheapest option can be a daunting task. This comprehensive guide will navigate you through the intricacies of car insurance, empowering you with the knowledge to make informed decisions and secure the most affordable coverage.

Whether you’re a seasoned driver or a first-time car owner, this guide will provide you with valuable insights and expert advice to help you save money on your car insurance premiums.

Company Comparison

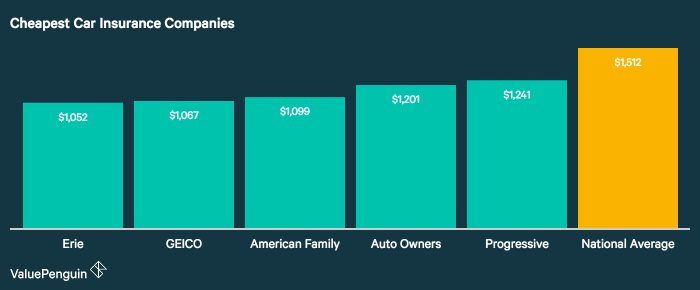

When searching for the most affordable car insurance, comparing different companies is essential. Several factors influence the cost of coverage, including the level of coverage, deductibles, discounts, and customer service ratings.

This table compares the top insurance providers based on these factors, helping you make an informed decision and find the best coverage for your needs:

Coverage and Deductibles

| Company | Coverage Options | Deductible Options |

|---|---|---|

| Company A | Liability, collision, comprehensive | $250, $500, $1,000 |

| Company B | Liability, collision, comprehensive, uninsured/underinsured motorist | $100, $250, $500 |

| Company C | Liability, collision, comprehensive, rental reimbursement | $500, $1,000, $2,000 |

Discounts

| Company | Discounts |

|---|---|

| Company A | Multi-car, good driver, safe driver |

| Company B | Multi-car, good student, low mileage |

| Company C | Multi-car, accident-free, paperless billing |

Customer Service Ratings

| Company | Customer Service Rating |

|---|---|

| Company A | 4.5 out of 5 stars |

| Company B | 4.2 out of 5 stars |

| Company C | 4.0 out of 5 stars |

Coverage Options

Car insurance coverage options vary in scope and purpose, impacting premiums and providing different levels of protection. Understanding the distinctions between coverage types is crucial for tailoring an insurance policy to your specific needs and budget.

The primary coverage options include liability, collision, comprehensive, and additional coverages such as uninsured/underinsured motorist protection, personal injury protection, and rental reimbursement.

Liability Coverage

Liability coverage is mandatory in most states and protects you financially if you cause an accident resulting in bodily injury or property damage to others. It covers medical expenses, lost wages, pain and suffering, and legal fees for the injured party.

Collision Coverage

Collision coverage protects your own vehicle in the event of an accident, regardless of fault. It covers repairs or replacement costs if your car is damaged or totaled in a collision with another vehicle or object.

Comprehensive Coverage

Comprehensive coverage extends beyond collision coverage and protects your vehicle from non-collision-related events such as theft, vandalism, fire, natural disasters, and animal collisions. It also covers damage caused by falling objects, broken glass, and certain weather-related incidents.

Factors Affecting Cost

The cost of car insurance premiums is influenced by several factors. Understanding these factors and optimizing them can help lower insurance costs.

The most significant factors that affect insurance premiums include:

Driving History

- A clean driving record, free of accidents and traffic violations, can significantly reduce premiums.

- Accidents and serious traffic violations, such as DUIs, can lead to higher premiums.

- Consider taking a defensive driving course to improve driving skills and potentially lower premiums.

Age

- Younger drivers, particularly those under 25, typically pay higher premiums due to their increased risk of accidents.

- As drivers gain experience and age, premiums tend to decrease.

Location

- Insurance premiums vary based on location. Areas with higher crime rates or traffic congestion tend to have higher premiums.

- Urban areas typically have higher premiums than rural areas.

Vehicle Type

- The type of vehicle insured also affects premiums.

- Sports cars and luxury vehicles typically have higher premiums than standard sedans or economy cars.

- Vehicles with higher safety ratings may qualify for lower premiums.

Credit Score

- In some states, insurance companies use credit scores to determine premiums.

- A higher credit score can lead to lower premiums, as it indicates financial responsibility.

- Improving your credit score can potentially save you money on insurance.

Discounts and Savings: Best Cheapest Car Insurance

Car insurance premiums can vary significantly, but there are ways to save money. Many insurance companies offer discounts for certain factors, such as:

Multi-car discounts:If you insure multiple vehicles with the same company, you may qualify for a discount on each policy.

Good driver discounts:Drivers with a clean driving record and no recent accidents or traffic violations may be eligible for a good driver discount.

Loyalty discounts:Some insurance companies offer discounts to customers who have been with them for a certain period of time.

Other discounts:Other discounts may be available for things like installing anti-theft devices, taking a defensive driving course, or having a good credit score.

Qualifying for Discounts

To qualify for discounts, you will need to meet the specific requirements set by the insurance company. For example, to qualify for a good driver discount, you may need to have a clean driving record for a certain number of years.

To qualify for a multi-car discount, you will need to insure multiple vehicles with the same company.

Maximizing Savings

To maximize your savings on car insurance, you should:

- Shop around and compare quotes from multiple insurance companies.

- Ask about all available discounts and make sure you qualify for them.

- Consider raising your deductible to lower your premium.

- Take advantage of any other opportunities to save money, such as bundling your car insurance with your home insurance.

Shopping Tips

Shopping for the cheapest car insurance can be a daunting task, but it doesn’t have to be. By following these tips, you can save money on your car insurance without sacrificing coverage.

Here are some tips for shopping for the cheapest car insurance:

Compare Quotes, Best cheapest car insurance

- Get quotes from multiple insurance companies before you buy a policy.

- Use an online insurance comparison tool to get quotes from several companies at once.

- Compare quotes side-by-side to find the best deal.

Negotiate with Insurance Companies

- Don’t be afraid to negotiate with insurance companies.

- If you have a good driving record, you may be able to get a discount on your insurance.

- You may also be able to get a discount if you bundle your car insurance with other types of insurance, such as home insurance or renters insurance.

Avoid Common Pitfalls

- Don’t buy more insurance than you need.

- Make sure you understand the terms and conditions of your policy before you buy it.

- Don’t be afraid to ask questions if you don’t understand something.

Read Insurance Policies Carefully

It’s important to read your insurance policy carefully before you buy it. This will help you understand what is covered and what is not.

Here are some things to look for when reading your insurance policy:

- The amount of coverage you have

- The deductible you have to pay

- The exclusions in the policy

End of Discussion

Remember, finding the best and cheapest car insurance is not just about saving money; it’s about protecting yourself financially and ensuring peace of mind on the road. By following the tips and advice Artikeld in this guide, you can secure the coverage you need without breaking the bank.