Embark on a journey of financial prudence and spiritual awareness as we delve into the world of auto insurance quotations. This isn’t just about numbers and premiums; it’s about securing your future, protecting your loved ones, and finding inner peace knowing you’ve made a wise and informed decision. Understanding the process of obtaining auto insurance quotes is a powerful step towards taking control of your life and achieving a sense of security that extends beyond the material realm.

We will explore the various factors influencing the cost of your insurance, from your driving history to the type of vehicle you drive. We’ll guide you through comparing different quotes, understanding policy documents, and ultimately securing the best possible coverage for your needs. This process is not merely transactional; it’s an opportunity for self-reflection, mindful decision-making, and ultimately, a deeper understanding of your responsibilities and your place in the world.

Understanding Auto Insurance Quotation Processes

Obtaining an auto insurance quotation involves several steps, from providing personal information to comparing different offers. Understanding this process is crucial for securing the best coverage at the most competitive price.

Steps in Obtaining an Auto Insurance Quotation

The process typically begins with an initial contact with an insurance provider, either online or through a phone call. This is followed by providing necessary information and receiving a quote. The process may conclude with policy purchase, or further comparison shopping if needed.

- Initial Contact (online or phone)

- Information Provision (personal details, vehicle information, driving history)

- Quote Generation

- Policy Purchase (or further comparison)

Information Requested by Insurance Providers

Insurance providers require comprehensive information to assess risk and generate accurate quotations. This information helps them determine the likelihood of an accident and the potential cost of claims.

- Personal Information (age, address, driving history)

- Vehicle Information (make, model, year, VIN)

- Driving History (accidents, violations, claims)

- Coverage Preferences (liability, collision, comprehensive)

Comparison of Quotation Processes Across Insurance Companies

Different insurance companies employ varying methods for obtaining quotations. Some utilize primarily online platforms, while others rely on phone-based interactions or a combination of both. The level of detail required may also differ.

- Online Quotation: Quick, convenient, often provides immediate results.

- Phone-Based Quotation: Allows for personalized interaction, but may be less efficient.

- In-Person Quotation: Offers a high level of personalization, but requires more time and effort.

Flowchart Illustrating the Customer Journey for Obtaining a Quotation

A typical customer journey for obtaining an auto insurance quotation can be visualized as a flowchart. This would begin with the customer initiating contact, followed by data input, quote generation, and finally, policy purchase or further comparison.

A visual representation would show a linear progression, starting with “Initiate Contact,” branching into “Provide Information,” leading to “Receive Quote,” with options to “Purchase Policy” or “Compare More Quotes.” The flowchart would highlight the decision points and possible paths within the process.

Factors Influencing Auto Insurance Quotation Costs

Several factors significantly influence the cost of auto insurance quotations. Understanding these factors allows for better preparation and potentially lower premiums.

Key Factors Determining Auto Insurance Costs

Numerous elements contribute to the final cost, including driving history, vehicle type, location, and coverage choices.

- Driving History (accidents, violations, claims)

- Vehicle Type and Age (make, model, year)

- Location (geographic area, crime rates)

- Coverage Level (liability limits, comprehensive, collision)

- Age and Experience of the Driver

Impact of Driving History on Quotation Prices

A clean driving record generally results in lower premiums. Accidents and traffic violations increase the perceived risk, leading to higher costs. The severity and frequency of incidents play a significant role.

Influence of Vehicle Type and Age on Insurance Costs

The type and age of the vehicle significantly affect insurance costs. Newer, more expensive vehicles typically command higher premiums due to higher repair costs. Sports cars and high-performance vehicles are also generally more expensive to insure.

Comparison of Cost Differences Based on Driver Profiles

The following table illustrates how different driver profiles can influence insurance costs. These are illustrative examples and actual costs vary widely depending on the insurer and specific circumstances.

| Driver Profile | Age | Driving Experience (Years) | Estimated Annual Premium (USD) |

|---|---|---|---|

| Young, Inexperienced Driver | 20 | 1 | $2000 |

| Experienced Driver | 45 | 20 | $1000 |

| Senior Driver | 65 | 40 | $1200 |

| Young Driver with Good Record | 25 | 5 | $1500 |

Comparing Auto Insurance Quotation Options

Effectively comparing auto insurance quotations requires a systematic approach, considering various factors beyond just the premium amount.

Types of Auto Insurance Coverage

Auto insurance policies offer various coverage options, each designed to protect against different types of losses. Understanding these options is crucial for choosing the right policy.

- Liability Coverage: Protects against damages caused to others.

- Collision Coverage: Covers damages to your vehicle in an accident.

- Comprehensive Coverage: Covers damages from events other than accidents (e.g., theft, vandalism).

- Uninsured/Underinsured Motorist Coverage: Protects you if involved with an uninsured driver.

Strategies for Comparing Multiple Auto Insurance Quotations

Comparing quotes involves analyzing not just the premium but also the coverage limits, deductibles, and exclusions. Using a spreadsheet or comparison website can streamline this process.

Essential Factors to Consider When Comparing Quotes

Several key aspects need careful consideration when comparing different insurance offers to ensure you’re getting the best value for your money.

- Premium Amount

- Coverage Limits

- Deductibles

- Exclusions and Limitations

- Customer Service Reputation

- Claims Process

Calculating the Total Cost of Insurance

The total cost of insurance includes both the premium and the deductible. Understanding how these components interact is essential for making informed decisions.

For example, a $1000 annual premium with a $500 deductible means that in the event of a claim, the insured would pay $500 upfront before the insurance company covers the remaining costs.

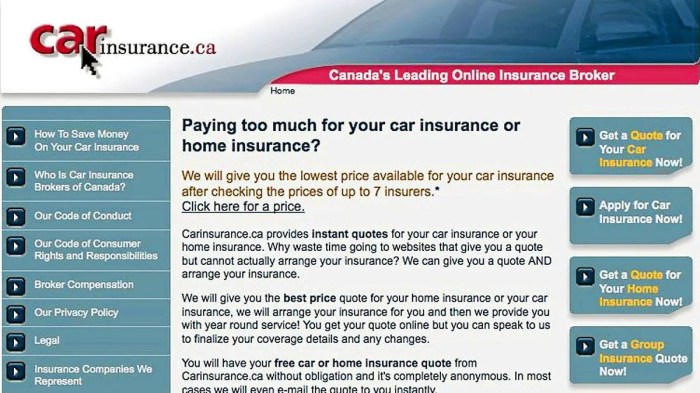

Online Auto Insurance Quotation Tools and Platforms

Online tools offer convenience and efficiency for obtaining auto insurance quotations. However, it’s important to be aware of potential risks and benefits.

Features and Benefits of Using Online Quotation Tools

Online platforms often provide quick, convenient quotes, allowing for easy comparison shopping across multiple insurers. They may also offer additional features such as policy management and claims reporting.

Comparison of User Interfaces and Functionalities

Different online platforms vary in their user interface design and functionalities. Some offer more personalized experiences, while others prioritize speed and simplicity. Features such as advanced search filters and detailed coverage explanations can vary significantly.

Potential Risks and Benefits of Using Online Quotation Services

While convenient, online services may lack the personalized interaction of a traditional agent. It’s crucial to carefully review the policy details before purchasing. The benefits outweigh the risks if used cautiously and with a clear understanding of the process.

User Interface Mockup for an Ideal Online Auto Insurance Quotation Tool

An ideal online tool would feature a clean, intuitive interface with clear navigation. It would allow for easy input of personal and vehicle information, provide multiple quote options, and offer detailed explanations of coverage options. A comparison table would facilitate side-by-side analysis of different quotes. The design would prioritize user-friendliness and transparency.

The Role of Technology in Auto Insurance Quotations

Technological advancements are transforming the auto insurance industry, impacting quotation processes and pricing strategies.

Impact of Telematics and Usage-Based Insurance

Telematics devices track driving behavior, allowing insurers to offer personalized rates based on actual driving habits. Safe drivers may receive discounts, while risky drivers may face higher premiums. This creates a more equitable system where drivers are rewarded for good driving.

Impact of AI and Machine Learning on the Quotation Process

AI and machine learning algorithms analyze vast amounts of data to assess risk more accurately, leading to more precise and personalized quotations. This reduces bias and improves efficiency in the quotation process. These technologies allow for faster processing and more tailored offers.

Use of Data Analytics to Personalize Auto Insurance Quotations

Data analytics play a crucial role in personalizing auto insurance quotations. By analyzing individual driving patterns, risk factors, and claims history, insurers can offer customized rates and coverage options. This approach aims to provide more relevant and cost-effective insurance.

Technological Advancements Influencing the Future of Auto Insurance Quotations

Several technological advancements are poised to further revolutionize the auto insurance landscape.

- Increased use of telematics and usage-based insurance.

- Wider adoption of AI and machine learning in risk assessment.

- Improved data analytics for personalized pricing and coverage.

- Blockchain technology for secure and transparent transactions.

- Development of predictive modeling for risk assessment.

Understanding Policy Documents and Fine Print

Thoroughly reviewing policy documents is crucial for understanding coverage details and avoiding potential misunderstandings.

Importance of Carefully Reviewing Policy Documents

Policy documents contain crucial information regarding coverage limits, exclusions, and claims procedures. Failing to understand these details could lead to unexpected costs or inadequate protection.

Common Exclusions and Limitations Found in Auto Insurance Policies

Most policies contain exclusions and limitations that restrict coverage under specific circumstances. These can include driving under the influence, using the vehicle for commercial purposes, or specific types of damage.

Examples of Potential Misunderstandings Related to Policy Terms

Misinterpretations of terms like “deductible,” “liability limits,” and “comprehensive coverage” can lead to significant financial implications. Clear understanding is essential to avoid such pitfalls.

Tips for Effectively Understanding and Interpreting Insurance Policy Language

When reviewing a policy, focus on key sections like coverage limits, exclusions, and claims procedures. Don’t hesitate to contact the insurer for clarification on any unclear terms or conditions. Seek professional advice if needed.

Securing the Best Auto Insurance Quotation

Several strategies can help secure the most competitive auto insurance rates.

Tips for Negotiating Lower Insurance Premiums

Negotiating lower premiums may involve comparing quotes from multiple insurers, demonstrating a good driving record, and bundling insurance policies. It’s also important to maintain a good credit score, as this can affect your premiums.

Strategies for Improving Your Driving Record to Reduce Costs

Maintaining a clean driving record is the most effective way to lower insurance costs. This includes avoiding accidents, traffic violations, and defensive driving techniques.

Importance of Bundling Insurance Policies

Bundling auto insurance with other policies, such as homeowners or renters insurance, can often result in significant discounts.

Ways to Reduce Your Risk Profile and Lower Your Insurance Costs

Reducing your risk profile can significantly impact your insurance costs. This includes installing anti-theft devices, taking defensive driving courses, and maintaining a good credit score.

Final Thoughts

As you navigate the landscape of auto insurance quotations, remember that this journey is not just about finding the lowest price; it’s about finding the right balance between cost and coverage. By approaching this process with mindfulness and intention, you’re not simply securing insurance; you’re securing a sense of peace and stability in your life. Embrace the wisdom gained through careful consideration and find contentment in knowing you’ve made a choice that aligns with your values and protects your future. May this journey lead you to a deeper appreciation for responsible living and the profound sense of security that comes with wise decision-making.