The digital labyrinth of auto insurance quotes: a bewildering maze of numbers, policies, and fine print. Each click, a gamble; each comparison, a potential saving. But fear not, intrepid navigator. This isn’t a game of chance, but a strategic maneuver. We’ll unravel the mysteries of online auto insurance, exposing the hidden algorithms and revealing the path to the most favorable rates. Prepare to navigate the complexities of coverage, premiums, and provider comparisons, armed with the knowledge to secure the best possible deal. This isn’t just about saving money; it’s about mastering the system.

Understanding the factors that influence your premium is the first step. Your driving history, the make and model of your vehicle, your location – these are all pieces of the puzzle. We’ll delve into the specifics of each, illustrating how seemingly insignificant details can significantly impact your final cost. We’ll then guide you through the online quote process itself, highlighting the pitfalls to avoid and the strategies to employ for maximum efficiency. Think of this as your survival guide in the wild west of online insurance.

Understanding Online Auto Insurance Quotes

Obtaining an auto insurance quote online has become increasingly convenient and efficient. This process allows you to compare rates from various providers without leaving your home. Understanding the factors involved and the steps to navigate the process effectively is crucial for securing the best possible coverage at a competitive price.

Factors Influencing Online Auto Insurance Rate Calculations

Several factors contribute to the calculation of your online auto insurance rate. These factors are analyzed by algorithms to provide a personalized quote. Understanding these elements can help you make informed decisions to potentially lower your premium.

- Driving History: Accidents, tickets, and DUI convictions significantly impact rates.

- Vehicle Information: Year, make, model, and safety features of your vehicle influence the risk assessment.

- Location: Your address determines the risk level based on factors like crime rates and accident frequency in your area.

- Coverage Options: The type and level of coverage you choose (liability, collision, comprehensive) directly affect the premium.

- Age and Gender: Statistically, younger drivers and certain gender groups may face higher premiums.

- Driving Habits: Some insurers consider factors like annual mileage and commuting distance.

Information Requested During the Online Quote Process

To generate an accurate quote, online platforms typically require specific information from you. Providing accurate details is crucial for receiving a fair and reliable estimate.

- Personal Information: Name, address, date of birth, driver’s license number.

- Vehicle Information: Year, make, model, VIN.

- Driving History: Details about accidents, tickets, and driving violations.

- Coverage Preferences: The types and levels of coverage desired.

- Payment Information: For some platforms, this may be requested to finalize the policy purchase.

Step-by-Step Guide to Obtaining an Online Auto Insurance Quote

The process of getting an online auto insurance quote is generally straightforward. Follow these steps for a smooth and efficient experience.

- Visit the insurer’s website.

- Begin the quote process by providing the required information.

- Review the quote details carefully, ensuring accuracy.

- Compare quotes from multiple providers.

- Choose the policy that best suits your needs and budget.

- Complete the purchase process, providing necessary documentation.

Comparison of Online Quote Platforms

Different online quote platforms offer varying features and user experiences. Consider factors like ease of use, customer service availability, and the range of insurance options offered when choosing a platform.

- Some platforms offer a streamlined and user-friendly interface, while others may be more complex.

- Customer service accessibility and responsiveness can vary significantly between platforms.

- The types of insurance coverage and add-on options offered may differ.

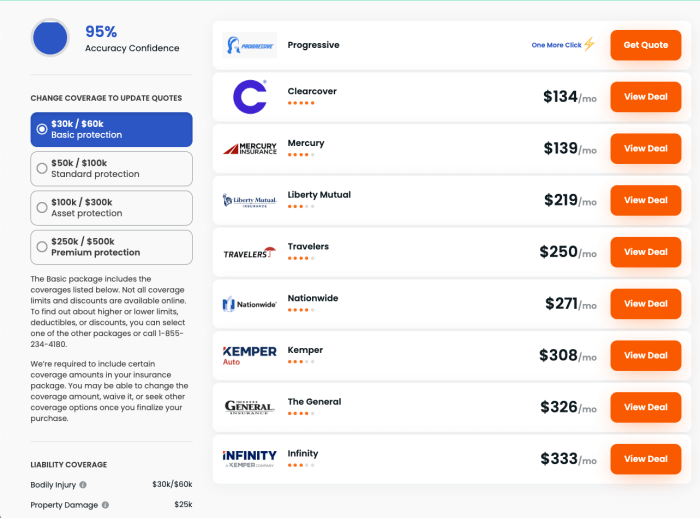

Comparing Auto Insurance Rates from Different Providers

Comparing quotes from multiple providers is essential to finding the best value for your money. This allows you to identify the provider that offers the most comprehensive coverage at the most competitive price.

Comparison of Auto Insurance Providers

| Provider Name | Quote Process Ease | Customer Service Rating | Special Features |

|---|---|---|---|

| Provider A | Easy and intuitive | Excellent; responsive 24/7 support | Accident forgiveness, telematics program |

| Provider B | Moderately easy; some complexities | Good; responsive during business hours | Roadside assistance, discounts for multiple policies |

| Provider C | Straightforward and quick | Average; limited online support | Bundling discounts, flexible payment options |

| Provider D | Somewhat complex; requires detailed information | Good; helpful and knowledgeable agents | Usage-based insurance, customizable coverage options |

Visual Representation of Average Rates

A bar graph could visually represent the average rates for each provider across different driver profiles. For example, the bars could represent average premiums for young drivers (under 25), experienced drivers (over 50), and drivers with accidents. The height of each bar would represent the average premium, allowing for easy comparison between providers and driver profiles. The graph would clearly illustrate the variations in pricing based on these factors.

Factors Affecting Auto Insurance Rates

Numerous factors influence the cost of your auto insurance. Understanding these factors allows you to make informed choices that could help lower your premiums.

Key Factors Impacting Auto Insurance Premiums

A range of personal and vehicle-related factors are considered when calculating your premium. These influence the insurer’s assessment of your risk profile.

- Driving History: Accidents and traffic violations increase your risk profile.

- Vehicle Type and Features: Expensive vehicles or those with advanced safety features may influence premiums.

- Location: Areas with higher accident rates or crime rates typically have higher premiums.

- Coverage Options: Higher coverage limits lead to higher premiums, but offer greater protection.

- Age and Gender: Statistically, younger drivers and certain gender groups may face higher premiums.

- Credit Score: In some states, credit scores are used as a factor in determining rates.

Influence of Driving History on Insurance Rates

A clean driving record is crucial for securing lower premiums. Accidents and traffic violations significantly increase your risk profile, resulting in higher premiums. The severity and frequency of incidents directly impact the increase in rates.

Impact of Vehicle Type and Features on Insurance Costs

The type of vehicle you drive plays a role in your insurance cost. More expensive vehicles, sports cars, and vehicles with high repair costs generally result in higher premiums. Conversely, vehicles with advanced safety features may qualify for discounts.

Influence of Location and Coverage Options on Premium Pricing

Your location impacts your premiums due to variations in accident rates and crime statistics. Areas with higher risk profiles typically result in higher premiums. The coverage options you choose directly affect your premium; more extensive coverage usually means higher costs, but greater protection.

Navigating the Online Insurance Quote Process

Successfully navigating the online quote process requires careful attention to detail and awareness of potential pitfalls. Following best practices ensures you obtain accurate quotes and protect your personal information.

Tips for Effective Navigation

- Compare quotes from multiple insurers.

- Provide accurate and complete information.

- Read the fine print carefully before accepting a quote.

- Understand the coverage options available.

- Check the insurer’s reputation and customer reviews.

Potential Pitfalls to Avoid

- Failing to compare quotes from multiple providers.

- Providing inaccurate information.

- Not reading the policy details carefully.

- Ignoring the insurer’s reputation and customer reviews.

- Rushing the process without fully understanding the coverage.

Protecting Personal Information

Ensure you are using secure websites (look for “https” in the URL) and avoid sharing sensitive information through unsecured channels. Review the insurer’s privacy policy to understand how your data will be used and protected.

Importance of Reviewing Policy Details

Before purchasing a policy, carefully review all the details, including coverage limits, exclusions, and premium amounts. Ensure the policy meets your specific needs and expectations.

Understanding Policy Coverage and Options

Several types of auto insurance coverage are available online. Understanding the benefits and limitations of each is essential to selecting a policy that adequately protects you.

Types of Auto Insurance Coverage

Auto insurance policies typically include various coverage options, each designed to address specific situations. The combination of coverages you choose influences your overall premium.

- Liability Coverage: Protects you if you cause an accident that injures someone or damages their property.

- Collision Coverage: Covers damage to your vehicle in an accident, regardless of fault.

- Comprehensive Coverage: Protects your vehicle from non-accident damage, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re involved in an accident with an uninsured or underinsured driver.

- Medical Payments Coverage (Med-Pay): Covers medical expenses for you and your passengers, regardless of fault.

Benefits and Limitations of Coverage Options

Each coverage option offers specific benefits but may have limitations. Understanding these nuances is crucial in making an informed decision.

- Liability coverage protects others, but not necessarily yourself.

- Collision coverage repairs your vehicle, but you may have a deductible.

- Comprehensive coverage is broader but may exclude certain events.

Comparison of Liability, Collision, and Comprehensive Coverage

These three are core coverage types. Liability is legally mandated in most states, while collision and comprehensive are optional but highly recommended.

- Liability: Lower cost, but limited protection for your vehicle.

- Collision: Higher cost, but covers damage to your vehicle in an accident.

- Comprehensive: Higher cost, but protects against a wider range of incidents.

Key Features to Consider When Choosing a Policy

- Coverage limits: Ensure they meet your needs and legal requirements.

- Deductibles: Choose a deductible you can comfortably afford.

- Premium cost: Balance cost with the level of protection offered.

- Customer service: Select an insurer with a good reputation and responsive customer service.

- Discounts: Inquire about potential discounts for safe driving, bundling policies, or other factors.

Final Wrap-Up

The hunt for the perfect auto insurance rate is a journey, not a sprint. Remember, the cheapest isn’t always the best; thorough comparison and understanding of your coverage needs are paramount. Armed with the knowledge gained here, you can navigate the digital landscape with confidence, securing a policy that provides adequate protection without breaking the bank. The power is in your hands; now, go forth and conquer your insurance costs.